Bibi’s controversial judicial reforms are blitzing the Israeli economy

The traditionally hardy Israeli economy is taking a nose dive thanks to the proposed bill dismantling the judiciary

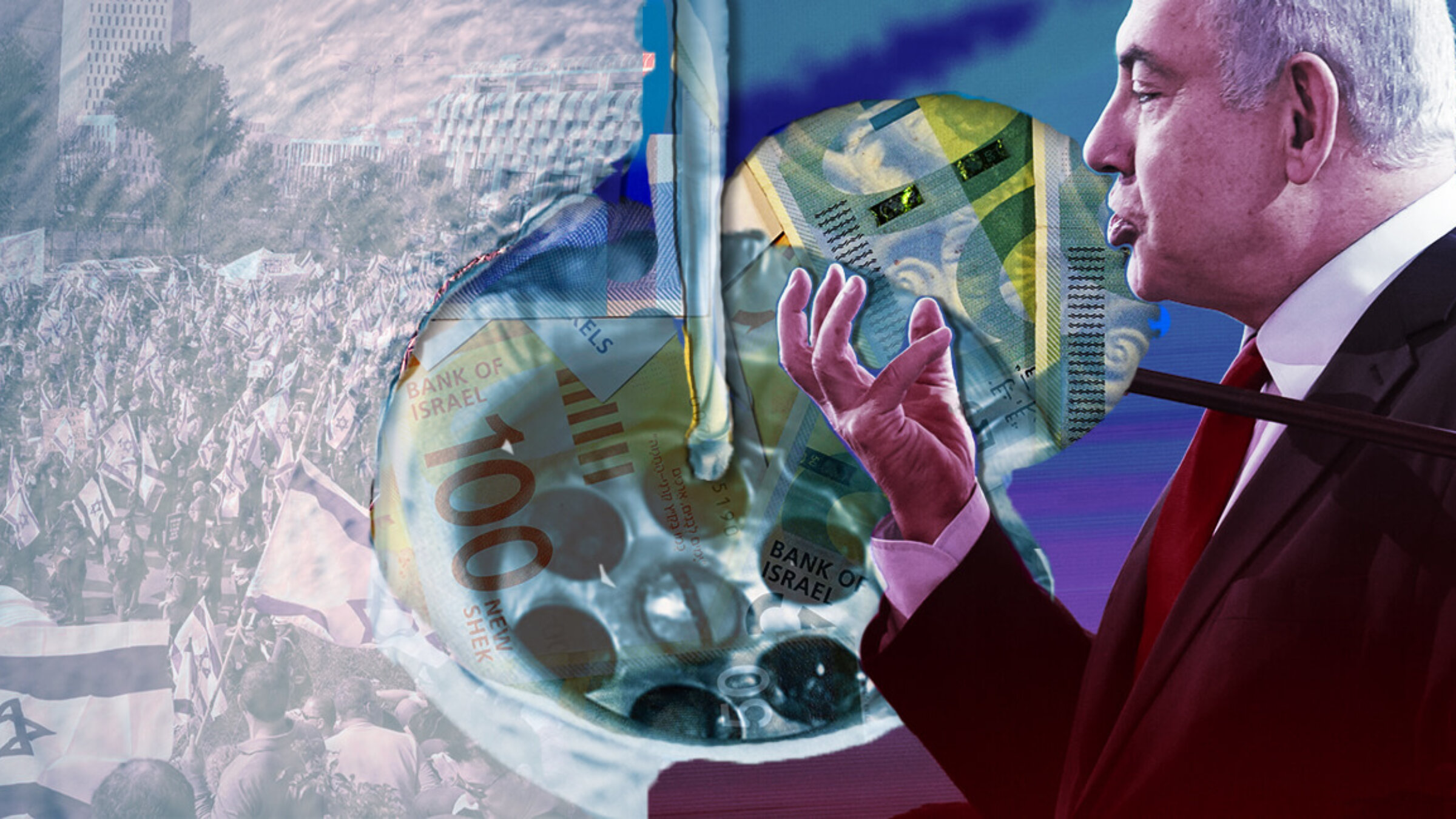

Prime Minister Netanyahu, right, proverbially flushing the Israeli economy down the drain as protestors, left, protest proposed judicial reform outside Israel’s Knesset building Photo-illustration by Laura E. Adkins

As Israel catapults toward a constitutional crisis, it is also heading for an economic one.

A day after a controversial judicial reform law, which would gut the Supreme Court’s power and independence, passed the first out of three readings in the Knesset, the Israeli shekel tumbled 2% – the biggest loss among major currencies that trading day — totaling about 5% loss this month alone.

This is remarkable: The Israeli economy has traditionally been resilient, its currency resisting wild fluctuations even through recent episodes of violence and military operations. It is more proof that the government’s proposed reforms will not only undermine Israeli democracy, but have real consequences that affect the lives and livelihood of Israelis immediately.

Citi predicts the shekel could lose another 8% if the Israeli government continues with all proposed judicial reform laws, which threaten the democratic character of Israel.

Among those championing these reforms is Prime Minister Netanyahu. Himself accused of numerous corruption charges, he stands to personally gain if all proposed reforms go through. But behind it all is an attempt to give de facto immunity to politicians in power and their friends and allies. Alarmingly, the government may also have a carte blanche to persecute political opponents. Members of the current coalition have called several times for those who oppose their views to be incarcerated for treason or incitement, just as they are in totalitarian countries.

The unprecedentedly large protests on the streets of Israel, the calls by President Herzog to negotiate and find a compromise, and even the international condemnation from Israel’s friends — including the United States — have all failed to deter the government. Prime Minister Netanyahu — while banned from publicly talking about the reform by the Attorney General given his clear conflicts of interest — continues to claim that his reform is legit.

Because they were elected by a slim plurality (49.5% of the vote), the current coalition claims to speak for the majority. But they fail to acknowledge that democracies are first and foremost about protecting the rights of minorities.

Weak democracy, weak shekel

Economists have been sounding the alarm about these reforms for the past few weeks, to no avail. In a letter signed by over 300 Israeli economists (me included), we warned the government that such a reform could have disastrous consequences for the Israeli economy.

As investors become distrustful of a judicial system that is not as independent as it was, to some extent controlled by the ruling coalition, there will be less appetite to invest in Israel.

In a nutshell, if investors — at home and abroad — have no independent judges to rely on in case of a dispute, why invest to begin with? If judges are beholden to the interests of politicians in power, it is almost guaranteed that any judicial conflict between independent investors and government will result in a win for the latter.

Investors are forward-looking, and these effects might be felt immediately. Credit agencies right now, for instance, are weighting the possibility of downgrading Israel’s rating reflecting the safety of investing there.

The devaluation of the shekel is a reflection of this reality: Capital has already started flowing out of the country to other destinations. This has direct consequences on the average Israeli’s cost of living. With a weakened shekel, importing goods becomes more expensive in the local currency — Israelis now need more shekels in order to buy, say, the imported food on which we’ve come to rely.

All this adds to the already high inflationary pressures that reign the global economy, including Israel, requiring more aggressive action by the Central Bank to increase interest rates. This will lead to Israelis paying higher mortgage monthly payments to boot.

The irony of it all is that Netanyahu himself historically advocated for and worked toward making Israel a free-market economy with an independent judiciary. But this time, it is Netanyahu who might destroy from within the economic successes that he has been credited for over the past 20 years in power.

By weakening Israel’s democratic institutions and jeopardizing the Israeli economy, he might achieve what the BDS movement has long dreamed of achieving: an Israel isolated from global markets.

The Israeli economy has gone through harsh periods before, such as the economic recession after the Yom Kippur War in 1973 that resulted in the inflation of the 1980s. But this time, if a doomsday scenario materializes, Israel won’t be able to count on its democratic allies in Western countries, such as the United States, to bail it out.

To contact the author, email [email protected]

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism so that we can be prepared for whatever news 2025 brings.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

Readers like you make it all possible. Support our work by becoming a Forward Member and connect with our journalism and your community.

— Rachel Fishman Feddersen, Publisher and CEO