Why Federations Funding Canary Mission Shouldn’t Surprise You

Image by iStock

This week, a series of exposés by Josh Nathan-Kazis in these pages revealed that an Israeli charity that appears to run the blacklist site Canary Mission received funding from a foundation controlled by the Jewish Community Federations of San Francisco. A second piece identified the Jewish Community Federation of Los Angeles communal fund as a second funder.

The response from the Jewish community was shock, a feeling of betrayal and outrage.

While Canary Mission’s tactics of blacklisting student activists may put it beyond the pale of acceptability, its financial model places it well within the norm of Jewish organizational practice.

The fact that Jewish federations and other Jewish public charities fund Canary Mission is simply business as usual.

Beginning In the 1970s, Jewish federations traded oversight over their grants for capital expansion. To understand how this happened, we need to examine the intersection of tax policy with Jewish philanthropy. The passage of the Tax Reform Act of 1969 enabled federations and community foundations to gain the privileges, including tax benefits and relaxed reporting requirements, of public charitable status.

By granting them that status, the government expressed its faith that they would act in the interest of the public good.

Private foundations, the other charitable category, were also expect to act on behalf of the public, but because they could carry the name and interests of a single individual, Congress determined to place more checks and steeper tax burdens on them.

Donor advised funds and supporting foundations, the two vehicles reportedly responsible for channeling Jewish charities’ dollars to Canary Mission, were the products of tax policy that advantaged public charities over private foundations.

Federations and community foundations, such as the Jewish Communal Fund or the Jewish Community Foundation of Los Angeles, capitalized on their advantages over private foundations. They could build their own assets and cultivate relationships by holding individuals’ charitable dollars in investment accounts. And, in turn, they could pass on some of their advantages, such as double tax benefits for appreciated assets and a flexible timeline for charitable allocation, to individual donors.

These new tax-based charitable vehicles had significant and immediate capital ramifications for public charities. In the span of just a few years, federations that had once held endowment funds that were modest at best could now boast of endowments in the tens of millions. And over time, federations and Jewish community foundations trained their donors to look to them as financial institutions, where they could warehouse charitable dollars and allocate them when and how they wished, all the while helping to sustain these community institutions.

Whatever the public benefits of tax-based charitable vehicles may be, they have inarguably changed how public charities conduct their business. This is because the law governing them diverges from practice. In law, individuals divest themselves of control over their charitable dollars the minute they house them in a public charity — or, in the case of supporting foundations, individuals give up a majority of seats on the board to the sponsoring organization, the public charity.

In practice, however, because public charities compete for individuals’ charitable dollars, they tend to exercise minimal oversight over them, a tendency all the more pronounced since the early 1990s when commercial entities, such as Fidelity, entered the field of operating donor advised funds.

In most cases, the sole standard for allocation from a tax-based fund held at a federation or community foundation is whether the potential recipient meets the requirement of §501(c)3 of tax code.

When federations and community federations first began to hold these funds, they assumed their donors’ allocations would, on the whole, reflect their missions. And indeed, the archives of allocations in the 1970s show that a high percentage of these funds were directed to federations, whether to fulfill annual campaign pledges or to allow federations to pursue special projects.

Nevertheless, federations and community foundations sold these tax-based funds to donors for their flexibility, their autonomy, and their growth potential.

And the more dependent public charities became on the funds, the less they could assert control over them.

So reliant have federations and community foundations become on tax-based charitable vehicles that the potential advantages of exercising oversight over them, for example, to consider whether allocation requests meet the mission of the public charity or even are simply channeling money to decent organizations, are far outweighed by the potential losses. Federations and community foundations have become unsustainable without these charitable funds; in 2013, donor advised funds and supporting foundations constituted almost 2/3 of federations’ total endowment assets, and the proportion for community foundations is far larger.

It’s no longer deniable: Jewish public charities have chosen capital expansion over capital oversight — just as in our larger political and economic world, capital regulation has been jettisoned in the interest of its growth.

Leftists may decry federations and community foundations for lending support and legitimacy to a hateful organization. But we can be confident that a different investigative reporter could just as easily find Jewish public charitable dollars flowing toward organizations embraced by the left and scorned by the right.

To the Jewish leaders who might revel in this fact and say it proves the inevitable balance of their ways, or who might cede to public pressure and disallow one or the other contribution, we must instead demand they and their institutions take responsibility for the consequences of their financial practices.

Capital growth does not exonerate us from political or ethical considerations.

Reports on Canary Mission’s funding sources will matter only if they lead us to confront the larger fact that capital decisions are political and ethical matters.

Are we content to allow capital growth to dictate the rules of our public institutions?

As long as we continue on the same course we have followed since the 1970s, we can expect federations and community foundations to exercise little to no control over ostensibly public resources. This is how a rag-tag organization that blacklists students for their political views wins public support.

More importantly, this is how business as usual wins the day, while so many of us lose.

Lila Corwin Berman is Professor of History at Temple University, where she holds the Murray Friedman Chair of American Jewish History and directs the Feinstein Center for American Jewish History. She is currently writing a book entitled “The American Jewish Philanthropic Complex: The Historical Formation of a Multi-Billion Dollar Institution.”

A message from our Publisher & CEO Rachel Fishman Feddersen

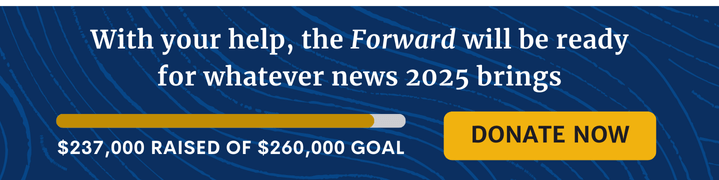

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO