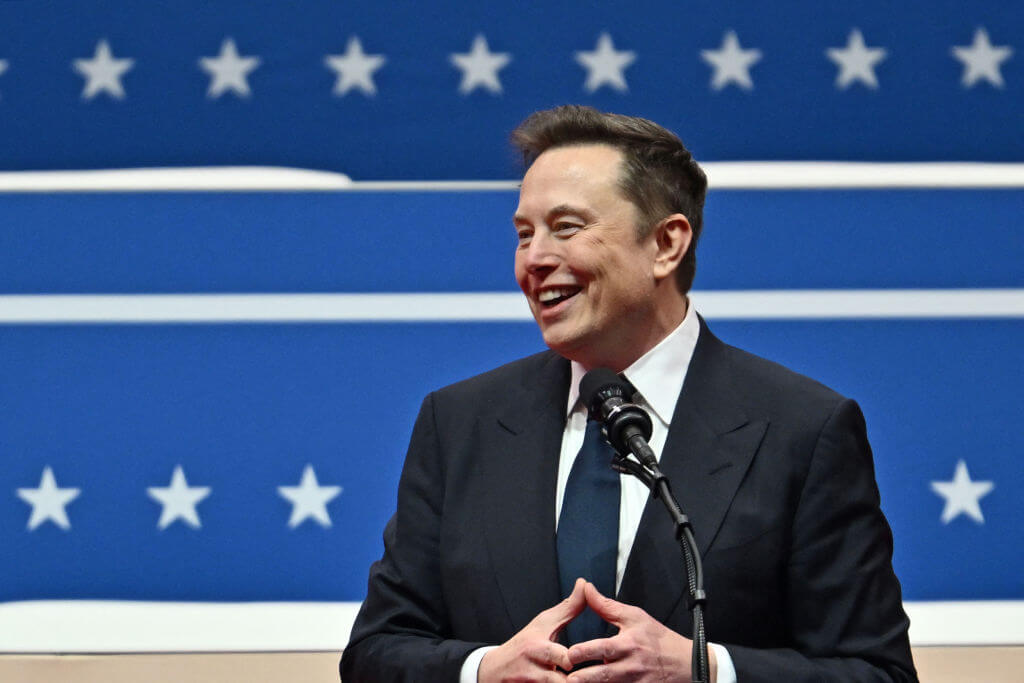

How a French Economics Prof Became U.S. Pop Idol

Image by Getty Images

Author-economist Thomas Piketty speaking at University of California-Berkeley, April 23, 2014 / Getty Images

If you haven’t yet gotten your copy of Thomas Piketty’s new book, Capital in the Twenty-First Century, you might as well relax. First of all, both Amazon and Barnes & Noble are sold out, so if you haven’t picked one up already, there’s no pointing in rushing out. Second, I’m about to give you a quick summary and point you toward some short readings that give you a taste while you wait. And then there’s always Kindle.

Piketty’s Capital is a publishing phenomenon. It’s a densely-written, 685-page analysis by a professor of modern economic history and theory, translated from French, that’s become a runaway international best-seller in the six short weeks since its publication in English March 10. The topic is inequality and the ability of free-market capitalism to mitigate it through growth and job creation. Piketty argues that it doesn’t work.

Unlike many popular books on the economy that spout opinion and toss in anecdotes, Piketty’s book is based on analysis of an unprecedented trove of data. He and a posse of colleagues collected hard numbers on income and wealth by digging through national tax records in the United States, Japan and a half-dozen European countries, going back to the beginnings of such record-keeping — in some cases more than two centuries. A lot of scholars and journalists are calling the result a game-changer that will prove as significant in redefining the terms of economic policy debate as Karl Marx in the 19th century, John Maynard Keynes between the world wars and Simon Kuznets and Milton Friedman in the postwar era.

Two new review-essays sum up Piketty’s findings and arguments in a few easily readable paragraphs. One is this Harvard Business Review blog post by Justin Fox, the executive editor of Harvard Business Review Group. The other, longer one is this essay by Jeff Faux, founder and currently distinguished fellow at the Economic Policy Institute, a labor-backed think tank in Washington. You can read them to save yourself the trouble of reading the entire book. A warning, though: They’ll probably make you want to read the whole thing.

But if you’re impatient, here’s the quick version:

Piketty’s basic thesis is that a pure free market economy tends naturally to redistribute income upwards. It was only because of two world wars and a Great Depression that America and the West experienced an anomalous 40 years of declining inequality, widespread prosperity and the emergence of a robust middle-class. The depression and world wars had the effect, first, of destroying vast amounts of accumulated wealth, and second, of permitting the political system to impose extremely progressive tax rates. High taxes on the rich, he writes, are the one thing that effectively prevents steadily growing inequality.

He argues further that, historically, most inequality results not from higher and lower salaries but from large fortunes, usually inherited. The major exception is current-day America, where corporate “super-managers” win huge salaries through their influence with their boards, allowing them to accumulate fortunes during their own lifetimes that they can then pass on.

Accumulated capital tends to grow faster than the overall economy, he says, and larger fortunes grow faster than smaller ones. Both tendencies have the effect of constantly widening the gap between the top and everyone else. It follows, too, that since salaries only rarely keep up with accumulated wealth, it’s a mistake to expect that strategies built on increasing individual opportunity — education and training, for example — can narrow the gaps.

The two top columnists on the New York Times Op-Ed page, liberal Paul Krugman and conservative David Brooks, wrote strong point-counterpoint essays yesterday (Friday) on Piketty-mania that capture the essence of the debate the book has touched off. Krugman’s piece, “The Piketty Panic,” takes on the conservative counter-attack that’s been mounted since the book appeared in English two weeks ago. He argues that the right is panicking because Piketty has irreparably demolished its arguments, resulting in a flood of name-callling instead of counter-arguments.

Brooks’ piece, “The Piketty Phenomenon,” reads like an unintentional illustration of what Krugman’s talking about. He argues that Piketty ignores the important role of human capital — including education and training — in narrowing the gaps.

I still maintain, as I argued some years back, that the best way to start thinking about inequality — if you’re wondering whether it really matters, or if you sense that does but you’re not sure how or why — is to check out the 10-part series by journalist Timothy Noah that ran in Slate.com in September 2010, “The Great Divergence.” It’s a painless, easily accessible, stunningly comprehensive explanation of what American economic inequality looks like and the various factors that contribute to it.

I also recommend my own blog post from September 2010, in which I pointed you toward several database websites with tax, income and inflation facts that let you do your own exploring.

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism so that we can be prepared for whatever news 2025 brings.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

Readers like you make it all possible. Support our work by becoming a Forward Member and connect with our journalism and your community.

— Rachel Fishman Feddersen, Publisher and CEO