Bush Tax Cuts, Meet Rabbi Kalonymus

One of the major questions in this election cycle has been whether the tax cuts enacted by President George W. Bush in 2001 and 2003 will be extended. These tax cuts include some relief for middle-class tax payers, but they primarily benefit the wealthiest two percent of Americans — those earning more than $250,000 a year. A fascinating episode in the Jewish legal literature of medieval Europe offers some guidance in determining the future of such tax breaks.

In the 13th century, Rabbi Simcha of Speyer, in the Rhine Valley, was approached with the following question: The head of state has exempted a certain Jew from paying the tax levied on the Jewish community — may he accept the exemption? Rabbi Simcha responds with a story:

“My uncle, Rabbi Kalonymus of blessed memory, was close to the king and a member of the king’s court. When the king wanted to levy a tax on the people of the city, he would help them to reach a reasonable compromise. Afterwards, he asked the king to reduce his own portion of the tax by a third or a quarter. Even though the king was willing to reduce his portion of the tax, Kalonymus changed his mind and gave his share along with the community. I used to think that he was acting out of compassion and lovingkindness. But now I see that he was acting out of justice, for all of Israel are responsible to one another to accept the yoke of exile, and will also all be partners in consolation and redemption” (quoted in Or Zarua 3:460).

Rabbi Kalonymus, his nephew concludes, pays his taxes together with the community not out of kindness, but out of a decision to throw his lot in with the rest of the Jewish people, in good times and in bad.

Furthermore, Rabbi Simcha rules, “It is known that all who dwell in a city and do business there are partners in all that is levied on them by the king or head of state.” Furthermore, he says, anyone who does secure a personal tax exemption must return this money to the community. When one person receives a tax exemption, everyone else in the community is forced to pay the difference. Therefore, any exemption granted should be understood as money that belongs to the community as a whole.

Like Rabbi Kalonymus, the beneficiaries of the Bush tax cuts are close to the head of state. Many donate generously to political campaigns. Others run companies that do business with the government. Still others simply have outsized power as a result of their wealth. Effectively, this small group of Americans was able to secure a personal tax break for themselves, at the expense of almost everyone else. If Congress does nothing, these tax breaks, along with the much smaller tax breaks for the middle class, will expire at the end of December. President Obama has proposed extending the middle-class tax breaks while allowing the tax breaks for the wealthy to expire on schedule. But mounting pressure from the right may push Congress to extend tax breaks for the wealthy for two years — or even indefinitely.

If extended, the tax cuts for the wealthiest will likely cost the United States close to $700 billion over the next 10 years. According to a report by the nonpartisan Tax Policy Center, most of that will benefit the wealthiest one-tenth of 1% of Americans. In the midst of an ongoing recession, the U.S. desperately needs this money to fund social services, create jobs and pay for public education. Per Rabbi Simcha’s warning, these exemptions for individuals strip money from the community as a whole. Allowing the tax breaks to expire will go some way toward returning the money to its rightful owners: the American public.

Today, most Americans suffer from lower incomes, devalued investments and fear about what the future will hold. In the midst of this frightening reality, it is tempting to look out only for one’s own short-term interests. In the long run, though, maintaining a sense of shared ownership with the whole will benefit us all. Retaining the tax revenue necessary to support social services, create jobs and get the country back on its feet will ultimately allow us all to become partners in “consolation and redemption.”

Rabbi Jill Jacobs is the author of “There Shall Be No Needy: Pursuing Social Justice Through Jewish Law and Tradition.”

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

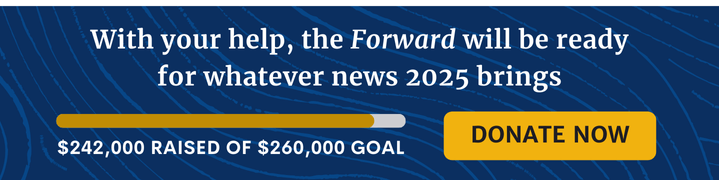

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO