ZOA’s Uncertain Status

Image by naomi zeveloff

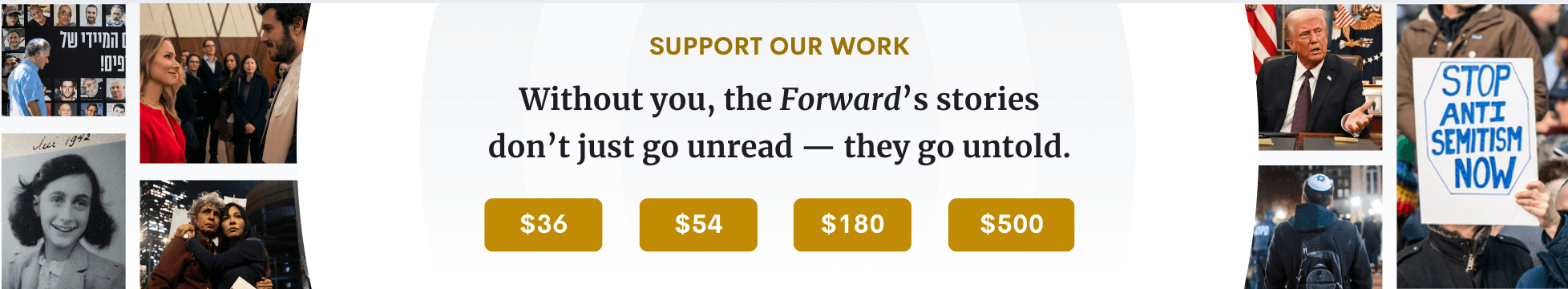

Gala Dinner: Morton Klein chats with Glenn Beck and Rep. Michele Bachmann at the Zionist Organization of America?s 2011 dinner. Image by naomi zeveloff

The Zionist Organization of America’s tax-exempt status has been revoked after the group missed three consecutive years of filings to the Internal Revenue Service, the Forward has learned.

The 115-year-old Zionist group has not been allowed to accept tax-deductible donations since February.

Read new Forward story about questions over ZOA

ZOA spokesman David Drimer, the group’s executive director, said that the sanction was the result of a “technical misunderstanding,” and that since it happened, the ZOA has “never intentionally” misrepresented itself . He said that the group is nearly ready to apply for a retroactive reinstatement of its tax exemption.

In an email provided to the Forward, ZOA tax attorney Tyler Korn wrote that “serious failures by the ZOA’s accountants, management and Board” led to the loss of the group’s exemption.

Drimer, who previously was associate publisher of the Forward, said that the lost exemption is no secret and that he talked “with numerous individuals about it every day.” But Drimer cited a memorandum prepared by Korn saying that the group has no obligation to broadly publicize the sanction.

That opposition to publicizing the lost exemption has been a cause of dissent on the group’s national board. Steven Goldberg, a vice chairman of the national board and the chair the ZOA’s Los Angeles chapter, has argued for broader public disclosure.

“I believe we have a fiduciary responsibility to disclose,” Goldberg told the Forward. “I don’t understand not telling people.”

The ZOA’s national board is set to meet at the organization’s offices today to discuss the issue.

An institution with roots in the beginning of the Zionist movement in America, the ZOA is now to the right of the American Jewish political spectrum. Former Fox News host Glenn Beck addressed the group’s annual dinner last November, as did Tea Party favorite Michele Bachmann. National president Morton Klein has led the ZOA for the past 18 years.

“Our tax attorney has told us he has every confidence we will shortly be reinstated,” Klein told the Forward.

The ZOA’s current trouble with the IRS began in May of 2011, when the organization missed the filing deadline for its 2008 Form 990s, the tax documents that the IRS requires exempt groups to file annually.

The ZOA, like many other exempt groups, habitually runs a few years behind in filings its 990s. Groups are not allowed to run three years late, however, and the missed 2008 filing made the ZOA three years delinquent.

According to Drimer, the missed deadline was due to a misunderstanding on the part of ZOA management and the group’s outside auditors. The 2008 990s were filed in November 2011, when the group believed them to be due. The IRS informed the group in February 2012 that the deadline had been in May 2011, and that the ZOA’s exempt status had been automatically revoked.

“It’s really just a technical, meaningless revocation,” Drimer told the Forward. Drimer began work at the ZOA after the organization had already missed the May 2011 deadline.

According to Drimer, the group scrubbed its website of claims to be a 501c3 once it received notice that it had lost its tax exemption.

“[S]ince [February 22, 2012], we have never intentionally represented the [ZOA] as being a 501c3,” Drimer wrote in an email. “[T]he revocation is not a secret, and [I] talk with numerous individuals about it every day.”

As of this writing, the website of at least one regional branch, the San Diego district, continues to state that the ZOA is a tax-exempt entity. Drimer said that the San Diego district’s website is not under the control of the national organization.

Klein said that he personally informed all major donors of the lost exemption. “I was really scared calling some of my major people that they would respond very uncomfortably, but they didn’t, not a single one,” Klein said.

The group’s national website currently refers donors to an outside not-for-profit that accepts donations on the ZOA’s behalf. According to Drimer, the ZOA has no access to those funds until its exempt status is reinstated.

In the email provided to the Forward, ZOA attorney Korn called for an examination of the failures that led to missing the deadline.

Separately, an outside counsel retained personally by Goldberg, the vice chairman, argued in a memorandum circulated to the board that board members could be held personally liable for failing to fully disclose the loss of the group’s exemption. Written by a California lawyer named Kent Seton, the memorandum was emailed to board members by Goldberg in late August.

The ZOA disputes the notion of any potential liability. “I do not agree that the ZOA had or has an affirmative duty to broadly publicize to donors the loss of exemption,” Korn wrote in the email provided to the Forward. “I also do not agree that donors would, in general, have any valid, corresponding claim for damages against the ZOA or its Board.”

Drimer noted that Seton is a California lawyer and the ZOA is a New York corporation, and asserted that the ZOA had done nothing wrong. “We have a legal opinion from our tax attorney that the ZOA has nothing illegal, immoral, or unethical in dealing with this situation from the time we were aware of the revocation,” he said. “There is no affirmative duty required. We didn’t keep it a secret.”

In an August 8 memorandum to Korn and the group’s leadership, Drimer outlined steps the ZOA would take to ensure future compliance with reporting requirements. The memo outlines infrastructure changes to develop consistency in bookkeeping between ZOA regional offices and the hiring of a full time staff accountant.

Contact Josh Nathan-Kazis at [email protected] or follow him on Twitter @joshnathankazis

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism so that we can be prepared for whatever news 2025 brings.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

Readers like you make it all possible. Support our work by becoming a Forward Member and connect with our journalism and your community.

— Rachel Fishman Feddersen, Publisher and CEO