For Teenage Girls, Lessons in Money Management

It never ceases to surprise me when I meet other women, most of them women who have or have had professional careers, who let their husbands take care of every detail of their family’s financial life.

I guess feeling compelled to have control (and share decision-making with my husband) over my and my family’s financial life is rooted in my mother’s experience. When she and my father split up after more than 20 years of marriage, I saw that she had to unlearn a lifetime of messages about what it meant to be a woman in order to feel empowered to take care of herself, financially speaking.

It turns out that that model of what it means to be a “wife” hasn’t changed, or perhaps hasn’t changed enough. Because when they leave college and set out on their own, young Jewish women are often not able to manage their own financial lives, according to Deborah Rosenbloom, director of programs at Jewish Women International.

“Women in general don’t know a whole lot about money. They feel okay about it if their husbands take charge of the finances. That’s across the literature about American young women, but our focus is on Jewish women,” Rosenbloom told The Sisterhood.

Her organization, which focuses on empowering women and girls, is now bringing a financial literacy education program, called Life$avings that it has been running elsewhere in the country, to New York.

And they are targeting girls younger than ever with their message. While over the past three years they have been working with young Jewish women in college and in the early stages of their careers, now they are reaching out to girls in high school.

The first meeting of the New York seminar will be a brunch for teen girls and their mothers on Sunday from 11 to 1 at the JCC of Manhattan. Karen Finerman, CEO of Metropolitan Capital Advisors, will speak about money management.

“We found that young Jewish women have expectations of marrying a guy with a good career and that they would not be the main breadwinner, or that their father would take care of them in some way,” Rosenbloom said. “We thought about how we could change that.”

Three years ago JWI began a financial literacy program in Baltimore for women in college and the few years beyond. The organization has since brought Life$avings to Jewish women at other colleges and recently formed an alliance with Sigma Delta Tau, a Jewish women’s sorority, to take it to their campuses.

“We started thinking if how great it would be for teen girls to understand money before they go to college.” Rosenbloom said. “Women tell us that they don’t talk with their daughters about asset-building or how to budget,” she said. With the program kicking off on Sunday, “We want to start their conversations.” (More information and a registration form can be found here )

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

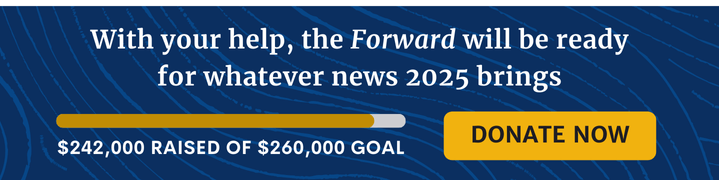

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO