Coping With the Cost of College: Grandpa Can Help

First, the bad news: If you have a child born after the year 2000, his or her total tuition bill for college could run in excess of a quarter-million dollars.

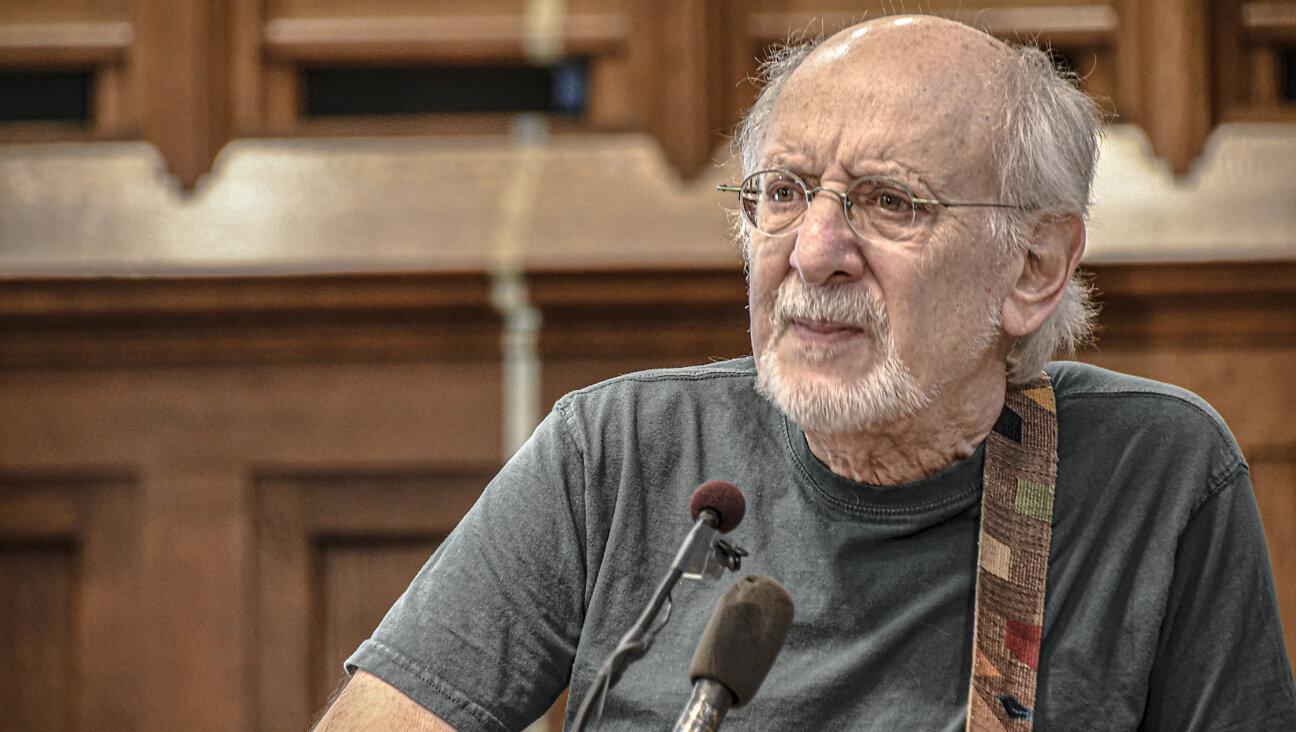

Now, the good news: Harold Simansky can help you. His new workbook — “College Costs How Much?!” — contains all the sober facts about the cost of education, and offers a range of suggestions to ease the burden.

Starting early is key, he writes. Parents can cover all the costs for a college-bound prince or princess if they start socking away $600 per month when Junior is still an infant. But if they wait until their son or daughter has reached adolescence, the savings become much scarier and more draconian; you’ll have to put away a whopping $10,000 per month to cover the bill if you refrain from saving until your child is 16.

State-sponsored savings plans can assist parents further, and Simansky lists tons of them. He goes through the various state-sponsored savings plans, state by state, and includes phone numbers, Web sites and his own personal recommendations. (For example, Rhode Island has one of the most expensive investment plans, while New York has one of the least expensive.)

But perhaps the best place to turn for assistance, he says, is closer to home: grandparents.

“The reality is, the wealthiest section of society is grandparents,” Simansky told the Forward, noting that bubbeh and zayde often have the “greatest amount of cash. They’ve paid off the house, [they’re] starting to think about estate planning and wealth transfer. A grandparent can do good, making the grandchild the recipient of tax savings and estate benefits. It’s a great untapped college source.”

According to a recent survey by the financial firm ING, only 2% of grandparents are saving for their grandchild’s college education. And those who are saving are not doing so in the best way. “The easiest and most direct way of helping out is simply by paying the bill,” Simansky writes in his workbook. “Do not give the money to either the parent or the student. Even if they immediately turn around and pay the school, the damage has been done because this payment would now be considered a gift for tax purposes.”

Simansky, a financial consultant with an Master of Business Administration from the Sloan School of Management at Massachusetts Institute of Technology got interested in this subject when his son, Aaron, was born three years ago.

“Here I was working in financial services, a graduate of MIT, and when I started [looking into savings programs], it was an absolute quagmire,” Simansky said. “There are layers of choices.”

It occurred to Simansky that if he was having trouble making sense of the various federal and state programs available to help parents save for college, it was almost certain that other people with less training were having trouble, too. So he founded Educational Investments (www.educationalinvestments.com), a Boston-based investment advisory firm that helps parents demystify the college-planning process.

“College Costs How Much?!” is the fruit of his research. “I was really going to use [my research] for a marketing brochure,” Simansky said. But as he got deeper and deeper into the topic, he decided to turn it into a book, which his firm published.

In addition to tackling college bills, Simansky’s book includes advice about saving for day schools. “Jewish day schools are easily approaching 15 to 20 thousand dollars per year,” Simansky said. “That’s a huge sum for most families. Generally Jewish day schools have been focused on building capacity: They have tremendous new day schools, buildings are nicer and they’re paying teachers better.” They’ve been upping their tuition to cover all these costs.

Fully 85% of day school students receive no financial aid, but many of those who are eligible never even apply for it. “It’s becoming the next gray issue — the issue of affordability,” Simansky said. “If you’re serious about sending [your kids] to school, camp, synagogue, it’s hugely expensive. Parents can’t foot the bill for everything.” To their credit, Simansky says that many day schools realize this, and it’s wise for parents (even those who think they make too much to qualify) to investigate their options.

Simansky’s rule of thumb comes down to this: “You sprinkle a little here, sprinkle a little there.” Then watch your young princelings bloom.

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism so that we can be prepared for whatever news 2025 brings.

At a time when other newsrooms are closing or cutting back, the Forward has removed its paywall and invested additional resources to report on the ground from Israel and around the U.S. on the impact of the war, rising antisemitism and polarized discourse.

Readers like you make it all possible. Support our work by becoming a Forward Member and connect with our journalism and your community.

— Rachel Fishman Feddersen, Publisher and CEO