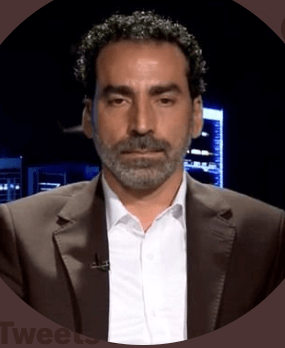

Gary Cohn Pushes ‘Singular Focus’ On Taxes In Battle With White House Right-Wingers

Gary Cohn Image by Getty Images

In a White House marked by infighting, top economic aide Gary Cohn, a Democrat and former Goldman Sachs banker, is muscling aside some of President Donald Trump’s hard-right advisers to push more moderate, business-friendly economic policies.

Cohn, 56, did not work on Republican Trump’s campaign and only got to know him after the November election, but he has emerged as one of the administration’s most powerful players in an ascent that rankles conservatives.

Trump refers to his director of the National Economic Council (NEC), as “one of my geniuses,” according to one source close to Cohn.

More than half a dozen sources on Wall Street and in the White House said Cohn has gained the upper hand over Trump’s chief strategist, Steve Bannon, the former head of the right-wing website Breitbart News and a champion of protectionist trade opposed by moderate Republicans and many big companies.

Cohn is a key administration link to business executives and White House sources say he will lead the charge for Trump on top domestic priorities such as tax reform, infrastructure and deregulation.

“Gary’s singular focus is tax reform and he’s working to try and get that done in 2017,” said Orin Snyder, a partner at law firm Gibson Dunn and a long-time friend of Cohn.

“He is working to implement the president’s twin goals of economic growth and job creation. The tax plan will also include a reduction in the corporate rate, but also tax relief for middle- and low-income Americans.”

Some conservatives fear Cohn may push through a tax plan that is unnecessarily complicated and argue that including tax relief for middle- and low-income Americans would not spur economic growth as much as cuts focused entirely or mostly on businesses and entrepreneurs.

Adam Brandon, president of the conservative group FreedomWorks, is disappointed Trump is not charging ahead with a plan unveiled last year during his campaign that would slash taxes on businesses and wealthy individuals.

That plan was shaped heavily by Stephen Moore, an economic policy expert at the conservative Heritage Foundation think tank, who advised Trump’s campaign. But it has since been shelved.

“I don’t like the idea of scrapping it and starting over again,” Brandon said.

A senior administration official said the White House has started from scratch on the tax plan and, while setting business tax cuts as the highest priority, is consulting with lawmakers, economists and business leaders before taking it to the Republican-led Congress.

Two administration officials said reports that the White House was considering a carbon tax and a value-added tax were incorrect, but that other ideas were on the table. “We are considering a multitude of options for tax reform,” a White House official said on Sunday.

RAPPORT

Associates of both Trump and Cohn say the two have developed a bond. People who have worked with Cohn say he is loyal, direct and assertive, traits that Trump likes.

Crucially, Cohn also has the trust of Jared Kushner, Trump’s adviser and son-in-law, and his wife Ivanka, Trump’s daughter.

Cohn hired his staff more quickly than other top officials, building a reputation for competence in an administration hurt by early missteps over healthcare reform and a travel ban, the sources said.

“Gary is a huge asset to the Trump administration. He’ll be of great help in eliminating unnecessary regulation, stimulating growth and reforming the tax code,” said billionaire hedge fund manager John Paulson, an early backer of Trump who knows Cohn through Wall Street circles.

The son of middle-class parents in Cleveland, Ohio, Cohn overcame dyslexia and worked in sales before elbowing his way into a position as a Wall Street trader and rising to become president and chief operating officer at Goldman Sachs Group Inc .

Kushner was a Goldman Sachs intern when he first crossed paths with Cohn. After Trump’s election victory, Kushner paved the way for Cohn to meet the president-elect, who had spent much of the campaign blasting investment banks as modern-day robber barons. Trump soon named Cohn his NEC director.

Apparently paying more heed to Cohn and other moderates on his team, Trump last week said he was open to reappointing Janet Yellen as Federal Reserve chairman when her term is up and he also held back from naming China a currency manipulator.

Both stances marked a reversal from his campaign when Trump criticized Yellen and vowed to label China a currency manipulator on “day one” of his administration, a move that could lead to punitive duties on Chinese goods.

Sources close to Cohn and inside the White House said there are sharp policy differences between Cohn and both Bannon and Reince Priebus, White House chief of staff.

A White House spokesperson denied there was a power struggle inside the West Wing.

Cohn has already put his stamp on regulatory policy by working with Kushner to successfully push Wall Street lawyer Jay Clayton for head of the Securities and Exchange Commission after billionaire investor Carl Icahn, an early Trump supporter, had vetted other candidates. Clayton’s nomination has been advanced to the Senate for a vote.

The vacant Federal Reserve vice chairman’s seat is a key regulatory role Cohn and his colleagues on the economic team want to fill soon. Cohn has interviewed nearly two dozen candidates and has whittled the list down. Randal Quarles, a veteran of the George W. Bush administration is one of several candidates left, a source familiar with the process said.

Cohn will also take a leading role in developing Trump’s infrastructure plan to rebuild airports, roads and bridges. The biggest challenge may be figuring out how to pay for the initiative, which Trump has estimated at $1 trillion.

While conservatives are concerned by Cohn, they note that Bannon is still part of Trump’s mercurial administration and that Cohn could fall out of favor as quickly as he has risen.

“Whoever is up today,” Brandon said, “could be gone tomorrow.”—Reuters

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO