Jewish-Founded American Apparel Files for Bankruptcy

Image by getty images

American Apparel Inc, known as much for its sexually charged advertising and controversial founder as for its fashion offerings, filed for Chapter 11 bankruptcy protection on Monday.

The Los Angeles-based company, which has not made a profit since 2009, joins a growing number of U.S. retailers selling to teens and young adults that have been unable to adjust to changing spending patterns and intensifying competition.

American Apparel, one of the only clothing retailers still manufacturing in the United States, said its stores and manufacturing operations would continue to operate normally under a restructuring deal reached with most secured lenders.

“If it can continue to operate through the upcoming holiday season and generate increased holiday revenue, it just might emerge from bankruptcy,” Jerry Reisman, bankruptcy attorney at Reisman Peirez Reisman & Capobianco LLP, said in an email.

However, he also said the company needed new creative direction and substantial additional financing.

American Apparel said it expected to cut its debt to $135 million from $300 million through the elimination of more than $200 million of bonds in exchange for equity.

The big loser will be founder Dov Charney, who was fired as CEO in December for alleged misconduct, including misusing company funds and failing to stop a subordinate from creating blog posts that defamed former employees.

Charney, who has filed several lawsuits against American Apparel, had for years before his ouster faced highly publicized lawsuits accusing him of sexual harassment.

Along with other shareholders, his stake will be wiped out, said Neil Saunders, chief executive of research firm Conlumino.

New York hedge fund Standard General LP holds as collateral Charney’s 42 percent stake in American Apparel, which the flamboyant Canadian founded in 1989. It is also the company’s biggest creditor, holding $15 million of debt.

Standard General said it remained committed to the company and that it was pleased the agreement with lenders would avoid disruption to its operations. As of Sept. 30, American Apparel had about 9,000 employees and 227 stores in 19 countries.

Secured lenders will provide about $90 million in debtor-in-possession financing, and have committed $70 million of new capital. The restructuring will take about six months.

The bankruptcy did not come as a surprise.

American Apparel said in August it might not have enough capital to sustain operations for 12 months.

As of Friday, the company had a market value of $20.5 million, based on its closing share price of 11.2 cents. The shares were halted on Monday.

Teen apparel retailers are struggling as customers switch to fast-fashion brands such as H&M, Forever 21 and Inditex’s Zara and online retailers such as Amazon.com Inc.

Other teen-focused retailers filing for bankruptcy in the past year include Wet Seal, Cache Inc and Deb Shops.

The American Apparel case is in U.S. Bankruptcy Court, District of Delaware, Case No: 15-12055.

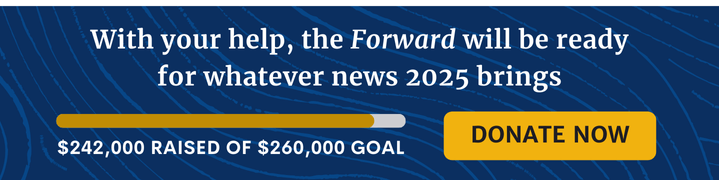

A message from our Publisher & CEO Rachel Fishman Feddersen

I hope you appreciated this article. Before you go, I’d like to ask you to please support the Forward’s award-winning, nonprofit journalism during this critical time.

We’ve set a goal to raise $260,000 by December 31. That’s an ambitious goal, but one that will give us the resources we need to invest in the high quality news, opinion, analysis and cultural coverage that isn’t available anywhere else.

If you feel inspired to make an impact, now is the time to give something back. Join us as a member at your most generous level.

— Rachel Fishman Feddersen, Publisher and CEO